GLOBAL EXPANSION STRATEGIES

Unveiling the Bold Global Expansion Strategies of Nigerian Banks: A Gateway to Unprecedented Growth

Global Expansion Strategies are essential for Nigerian banks aiming to unlock international market value and mitigate domestic risks.In the dynamic landscape of global finance, Nigerian banks have long been trailblazers, showcasing the prowess of indigenous brands on the international stage. Over the past decade, names like Access Bank, Fidelity Bank, and Zenith Bank have solidified their positions, spearheading acquisition deals that transcend borders, marking their imprint in regions far and wide. This surge in global dominance signifies a pivotal shift, with Nigerian financial giants venturing beyond the familiar terrain of Africa, expanding into the uncharted territories of Europe and Asia, propelling their growth trajectory to unprecedented heights.

With an eye on offshore expansion, Nigerian banks have continuously sought avenues to bolster revenue streams and attract investment, recognizing the imperative of diversification in navigating domestic risks. The year 2023 witnessed a paradigmatic leap, as three prominent banks—Fidelity, Zenith, and Access—embarked on ambitious ventures poised to unlock immense value in the international arena. Fidelity's strategic acquisition of Union Bank UK's subsidiary mirrors a calculated move to tap into the UK market, while Zenith Bank's collaboration with the French government signals a foray into the European domain. Meanwhile, Access Bank's strategic blueprint encompasses fortifying its presence in the burgeoning Asian market, signaling a concerted effort to enrich its global portfolio.

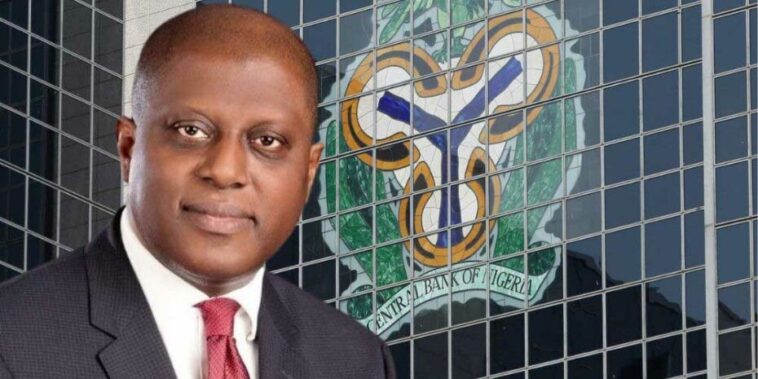

The impetus for this global thrust is underscored by the impending recapitalization exercise mandated by the Central Bank of Nigeria (CBN), poised to redefine the banking landscape and fortify the foundation for Nigeria's ambitious $1 trillion economy vision by 2026. The current capital framework, albeit robust, falls short in aligning with the grandiose economic aspirations, necessitating a recalibration to enhance banks' capacity and resilience. Against this backdrop, Nigerian banks are compelled to transcend conventional growth paradigms, venturing beyond the confines of the domestic market to mitigate risks and unearth new revenue streams amid economic volatility and regulatory flux.

Preceding the recapitalization fervor, Nigerian banks had long recognized the latent potential of global expansion, strategically positioning themselves to harness international growth opportunities. Fidelity Bank's proactive overtures, culminating in the acquisition of Union Bank UK, underscore a visionary approach to expansion, conceived well before the recapitalization discourse gained momentum. Such strategic endeavors epitomize a broader narrative of Nigerian banks transcending geographical constraints, embracing innovation, and forging symbiotic alliances to navigate the intricacies of the global financial landscape.

Against the backdrop of the African Continental Free Trade Area (AfCFTA) agreement, Nigerian banks are poised to leverage regional integration, capitalizing on the burgeoning opportunities of free trade across African borders. The mass migration phenomenon, colloquially termed “ja-pa,” has emerged as a lucrative avenue for Nigerian banks to tap into the burgeoning diaspora market, facilitating seamless remittances and investment inflows. Moreover, strategic partnerships with global financial institutions have emerged as a linchpin, endowing Nigerian banks with access to unparalleled expertise, resources, and market networks, catalyzing their foray into the global arena.

In an era defined by digital disruption, Nigerian banks are at the vanguard of innovation, harnessing cutting-edge technologies to enhance competitiveness and cater to evolving customer demands. The advent of digital banking and fintech innovations underscores a seismic shift, compelling banks to recalibrate their operational paradigms and elevate customer experience standards. Fidelity Bank's pioneering strides in digital innovation epitomize a concerted effort to transcend conventional banking boundaries, propelling Nigeria's banking sector into the echelons of global prominence.

Navigating the complexities of cross-border operations necessitates stringent adherence to international regulatory frameworks and best practices, underpinning banks' credibility and stakeholder trust. Fidelity Bank's unwavering commitment to corporate governance, risk management, and regulatory compliance underscores a resolute dedication to sustainable growth and resilience in the global arena. By embracing robust risk management frameworks and embracing regulatory imperatives, Nigerian banks are poised to emerge as formidable players, propelling Nigeria's economic narrative onto the global stage.

As Nigerian banks continue to chart their trajectory on the global arena, they are poised to emerge as beacons of resilience and dynamism, driving sustainable growth and contributing to Nigeria's economic ascendancy on the global stage. With each strategic alliance, technological innovation, and regulatory compliance initiative, Nigerian banks are rewriting the narrative of African financial prowess, beckoning a new dawn of prosperity and opportunity on the global stage. In the crucible of international finance, Nigerian banks stand poised to orchestrate a symphony of growth and resilience, shaping the contours of a new era in global finance.

As Nigerian banks venture into global expansion strategies to secure growth beyond domestic borders, it's evident that the landscape of global finance is rapidly evolving. With a focus on tapping into international markets and diversifying revenue streams, these banks are not only reshaping their own futures but also presenting unique opportunities for investors and consumers alike.

In this dynamic era of global finance, understanding the intricacies of international banking and investment has never been more crucial. Whether you're an aspiring investor seeking to capitalize on emerging markets or a seasoned financial enthusiast looking to stay ahead of the curve, now is the time to explore the diverse array of products and services available in the realm of global finance.

Join us as we delve into the world of global finance, uncovering valuable insights and opportunities that can help you navigate the ever-changing landscape of international banking and investment. From innovative financial instruments to strategic investment opportunities, there's something for everyone looking to capitalize on the exciting developments in global finance. Embrace the future of banking and investment today, and unlock the potential for growth and success on a global scale.

Shop Products On Amazon

Shop Products on Ebay

Trending Similar Stories in the News

International expansion strategies for mid-sized companies webinar replay - Citigroup

November 11, 2023 - CitigroupInternational expansion strategies for mid-sized companies webinar replay Citigroup...

The growth code: Go global if you can beat local - McKinsey

June 23, 2023 - McKinseyThe growth code: Go global if you can beat local McKinsey...

Trending Videos of GLOBAL EXPANSION STRATEGIES

Global Banking Trends

Banking Top 10 Trends for 2022 MICHAEL ABBOTT, Senior Managing Director – Global Banking Lead in his latest article ...

Similar Popular Articles

Border Reopening Sparks Joyous Festivities Along Sokoto's Frontier

AMVCA 10 Nominations: Over The Bridge and Breath Of Life Lead the Pack

Enugu State Governor Commits to Sustained Wage Awards Until New Minimum Wage Implementation

Breaking: Catholic Bishops Urge Tinubu to Free Nnamdi Kanu – Nigeria News Roundup

#GlobalExpansion, #BusinessGrowth, #NigeriaNews, #InternationalBusiness, #EconomicGrowth, #FinanceNews, #BankingIndustry, #MarketExpansion, #GlobalFinance, #FinancialInnovation

Global Banking Trends, International Finance Updates, Cross-Border Expansion Insights, Global Market Strategies, Economic Growth Initiatives, International Business Expansion, Financial Market Developments, Global Investment Opportunities, Strategic Expansion Tactics, Worldwide Banking Trends