FTX trial fallout

FTX Trial Fallout: Shockwaves, Scandal, and Regulatory Ripples in Crypto World

FTX trial fallout has sent shockwaves through the crypto industry, leaving regulators scrambling to address the aftermath of this unprecedented collapse.

FTX Trial Fallout: Crypto Industry Navigates Uncharted Waters

In the fast-paced world of cryptocurrencies, the collapse of the FTX platform sent shockwaves that reverberated worldwide. The disgraced former boss, Sam Bankman-Fried, is set to face a high-stakes trial in New York, raising questions about the regulatory landscape of the entire crypto sector. At Naija NewsBurrow News Network, we delve deeper into the story, shedding light on the multifaceted dimensions of this unprecedented event.

The Meteoric Rise and Sudden Fall of FTX

Once hailed as the wunderkind of the crypto world, Sam Bankman-Fried’s journey took a dramatic turn. Accused of seven counts of fraud, he now stands on the precipice of a lengthy prison sentence. FTX, once the world’s second-largest cryptocurrency exchange, crumbled amidst allegations that it funneled client funds to support its investment arm, Alameda.

As rumors swirled, investors began to withdraw their assets, pushing FTX into bankruptcy and leaving Bankman-Fried isolated and financially ruined. The crisis didn’t stop there; it triggered a mass exodus of capital from the speculative crypto industry and resulted in the downfall of several other businesses.

The “Wild West” of Cryptocurrency

Critics have long dubbed the cryptocurrency sector the “Wild West” due to its enticing promises of high returns in a volatile market, coupled with a lack of regulatory oversight. This combination creates a breeding ground for criminals seeking to launder money, a concern that regulators are now taking more seriously than ever.

The industry watched as crypto firms with significant exposure to FTX crumbled, including Genesis and the BlockFi platform, alongside numerous lenders. Erica Stanford, a fintech specialist at CMS, aptly described the situation, saying, “I’m seeing the crypto collapses from last year like dominos” following FTX’s demise. Beyond these high-profile collapses, many cryptocurrency projects unrelated to FTX also bit the dust.

The Shadow of Ponzi Schemes

Erica Stanford, the author of the best-selling book “Crypto Wars,” didn’t mince words when she pointed out that many of the fallen projects resembled clear Ponzi schemes, designed to lure unsuspecting consumers with the promise of quick riches. The FTX bankruptcy had far-reaching effects, impacting not only investors but also individuals deeply entrenched in the crypto industry.

Legal Fireworks: Accusations Against Bankman-Fried

US prosecutors leveled a barrage of accusations against Sam Bankman-Fried, alleging that he not only diverted funds from FTX clients but also engaged in wire fraud, securities fraud, commodities fraud, and money laundering. The storm surrounding FTX ultimately led to the demise of a virtual trading business once valued at a staggering $32 billion.

The Crypto Capital Crunch

With global interest rates on the rise, a substantial amount of capital was pulled from digital assets. Banafsheh Fathieh, a general partner at US digital asset investment group Faction, commented, “Capital is scarce in crypto these days.” Venture dollars dwindled for five consecutive quarters, and crypto trading volumes hit their lowest point in approximately four years. These economic indicators paint a picture of a sector facing significant challenges.

Missed Momentum for Crypto Regulations

Most cryptocurrencies, including Bitcoin, operate on decentralized blockchain technology, allowing them to largely evade regulatory oversight. However, the FTX fallout prompted global regulators to spring into action. In June, the US Securities and Exchange Commission (SEC) slapped a litany of charges against Binance, the world’s largest cryptocurrency exchange, and Coinbase, a major US player.

The SEC has long argued that certain digital currencies should be treated as financial securities, akin to stocks or bonds, necessitating their supervision as investment products. On a parallel front, the European Union adopted the Markets in Crypto-Assets regulation to ensure comprehensive oversight, safeguarding investors and consumers alike.

Despite these efforts, Arthur Carvalho, a specialist at Miami University, noted that US authorities may have “missed the momentum” to enact crypto-focused legislation immediately after the FTX bankruptcy. He emphasized the detrimental impact of the absence of proper regulations, highlighting the need for a regulatory framework in the industry.

Further Industry Shocks: Tech-Industry Lender Failures

The crypto sector faced additional blows with the failures of tech-industry lender Silicon Valley Bank, which occurred in close succession to the demise of US crypto lenders Silvergate and Signature. These developments further underscore the fragility of the industry and the need for robust risk management.

In conclusion, the FTX trial fallout has left the crypto industry grappling with unprecedented challenges and regulatory scrutiny. As the sector navigates these uncharted waters, it must find a delicate balance between innovation and investor protection. The shockwaves from this event will undoubtedly continue to reverberate, reshaping the future of cryptocurrencies in ways yet to be fully realized.

Join the conversation and share your insights on this evolving story. How do you believe the crypto industry can emerge stronger and more resilient in the face of these challenges? Let us know in the comments below, and stay tuned to Naija NewsBurrow for more in-depth coverage of this unfolding narrative.

[ad_1]

FTX Trial Fallout: Shockwaves, Scandal, and Regulatory Ripples in Crypto World

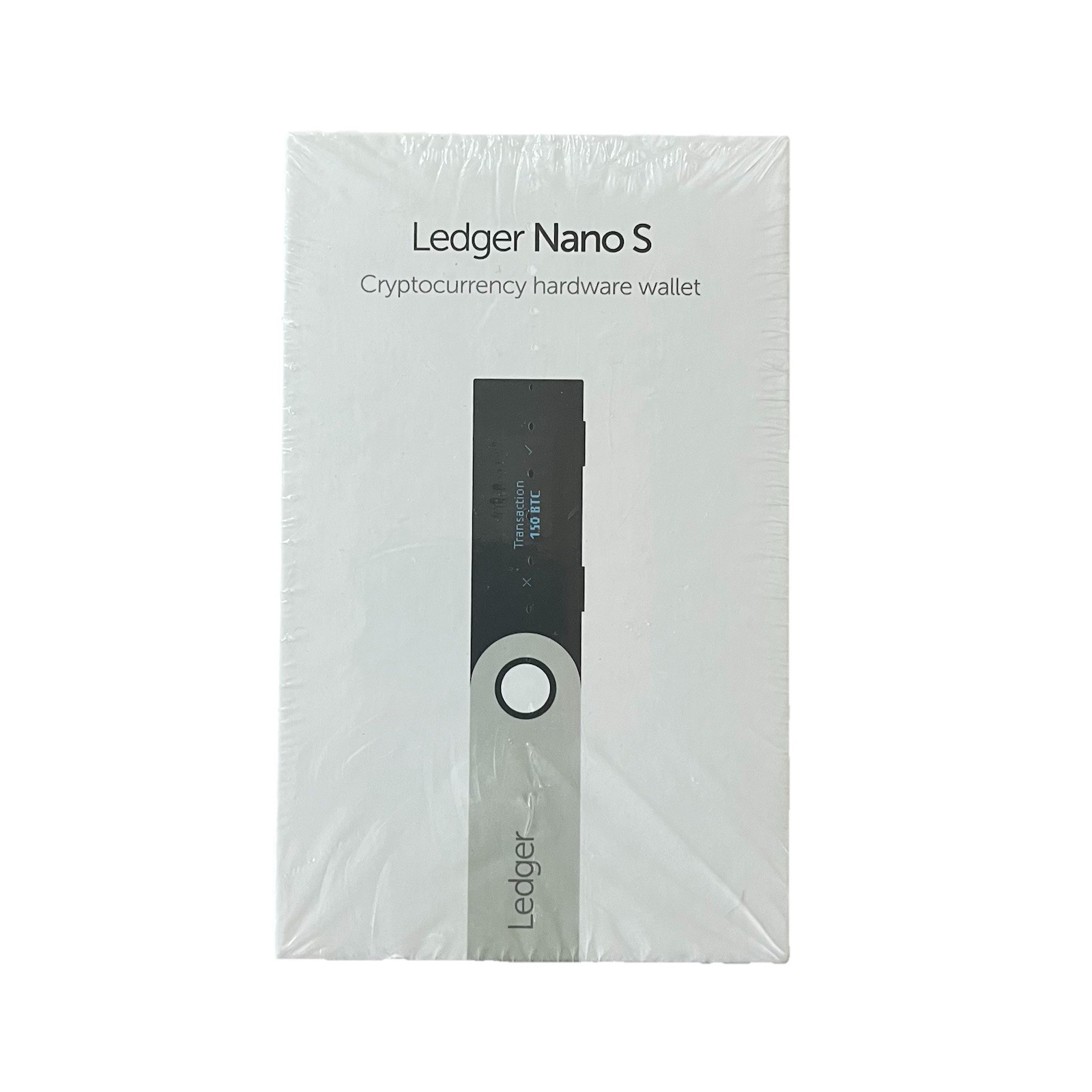

In the wake of the FTX trial fallout, the crypto industry finds itself at a crossroads, grappling with the repercussions of a once-thriving platform’s dramatic collapse. As we delve into the intricate web of events that led to this monumental downfall, it becomes clear that the need for secure cryptocurrency storage solutions has never been more pressing. The chaos that unfolded, from allegations of misappropriated funds to regulatory crackdowns, highlights the critical importance of safeguarding your digital assets.

In this ever-evolving landscape, one phrase reverberates: cryptocurrency hardware wallets. These innovative devices offer a secure sanctuary for your digital wealth, immune to the turbulence that has shaken the crypto realm. As we navigate through the tumultuous aftermath of FTX, it’s evident that taking control of your cryptocurrency investments is paramount. The path to stability begins with securing your assets through reliable hardware wallets, fortifying your financial future in a world where uncertainty has become the norm.

[ad_1]

Shop Products On Amazon

[ad_1]

Shop Products on Ebay

[ad_1]

Trending Similar Stories in the News

Crypto industry grapples with FTX fallout as trial looms Yahoo News...

Crypto Industry Grapples With FTX Fallout As Trial Looms Barron's...

[ad_1]

Trending Videos of FTX trial fallout

Bitcoin Advocate Warns of Impending Decapitalization of Crypto Industry

Crypto Industry DOOMED in the US? Shocking News from Industry Insider!

[ad_2]

Similar Posts, Popular Now

Nigeria’s Stunted Growth: Unraveling the Tragic Tale of Mohbad and the Nation’s Leadership Crisis

Investigation Unveils Shocking Details of Kogi Political Violence

In President Tinubu’s Independence Address, Calls for Unity and Economic Reform Resonate

Shocking Police Assault on Woman Sparks Outrage in Anambra

Breaking News: Ondo Church Members’ Harrowing Kidnapping Ordeal Shakes the Nation

FTX Trial Fallout: Shockwaves, Scandal, and Regulatory Ripples in Crypto World

💬 What’s your take? Drop a comment below! ⬇️

#BreakingNews #LatestUpdate #StayInformed

📖 Read More: https://tinyurl.com/2yuuxxnb